Evaluation of the decommissioning fund for a nuclear power plant in Brazil

DOI:

https://doi.org/10.15392/2319-0612.2022.1835Keywords:

Decommissioning, Costs, Funds, Reactor, EvaluationAbstract

The decommissioning of a nuclear power plant is a costly and highly complex process, requiring not only a planning and rigorous chronogram execution as well as funds large enough to cost it. The Long-Term Operation of the plant is not only interesting since it allows the plant to keep producing energy with low-carbon footprint as well as postpone to future these expenses. Around the world several nuclear power plants are being evaluated for Long-Term Operation due to these reasons. In Brazil the oldest nuclear plant, Angra 1, is also being evaluated for Long-Term Operation, otherwise it should be retired/shutdown in next future. However, besides the technical reasons, also the plant’s decommissioning fund seems to be not enough to cost its decommissioning. In the present work, the decommissioning fund of Angra 1 is evaluated considering two different interest rates and compared with the decommissioning cost. The results demonstrates that the Long-Term Operation is necessary and a good decision since it allow an additional time to the provisions on the decommissioning cost increase, avoiding the lack of funds.

Downloads

References

Monteiro, D.B.; Moreira, J.M.L.; Maiorino, J.R., “A new management tool and mathematical model for decommissioning cost estimation of multiple reactors site”. Progress in Nuclear Energy, vol. 114, pp. 61-83 (2019). DOI: https://doi.org/10.1016/j.pnucene.2019.03.004

Monteiro, D.B.; Moreira, J.M.L.; Maiorino, J.R., “A method for decommissioning strategy proposal and a cost estimation considering a multiple reactor site with interdependent plants”. Progress in Nuclear Energy, vol. 127, 103440 (2020). DOI: https://doi.org/10.1016/j.pnucene.2020.103440

Monteiro, D.B., “Decommissioning of the Nuclear Power Plants in Brazil: Proposal of a management tool for the decommissioning cost estimation”. PhD Thesis. UFABC (2017).

“Almost all U.S. nuclear plants require life extension past 60 years to operate beyond 2050”. EIA. Available at: https://www.eia.gov/todayinenergy/detail.php?id=19091. Last accessed: 29 Dec. 2021.

BRASIL, Federal Account Court – TCU, Evaluation Report: Decommissioning Fund of Angra 1 and 2 Nuclear Power Plants (Eletrobras Termonuclear S.A. – Eletronuclear), 2011.

BRASIL, National Agency of Electrical Energy - ANEEL, Technical Note No221/2015-SRM-SGT/ANEEL, Subject: Method to calculate the revenues from the sale of Angra 1 and Angra 2 NPPs energy, 2015.

BRASIL, Nuclear Energy National Commission, CNEN. Decommissioning of Nuclear Power Plants, Science and Technology Department, Resolution N°133, DOU, nov./21/2012, 2012.

Moreira, J. M. L., Kobayashi, G., Rossi, P. C. R., Monteiro, D. B., Rodrigues, P. H. S., Castellanos, D. Preliminary Decommissioning Plan for the CNAAA. Document No. UFABC-DESCOM2-020-Rev01, Universidade Federal do ABC, Santo André, Brazil (2018).

BRASIL, Eletrobras- Eletronuclear, “Balanços patrimoniais” – 2018, 2018.

BRASIL, Brazilian Central Bank – BCB, Citizen Calculator. Available at: https://www3.bcb.gov.br/CALCIDADAO/publico/corrigirPorIndice.do?method=corrigirPorIndice. Last accessed: 20 Dec. 2021.

BRASIL, Eletrobras – Eletronuclear, Social responsability management report – 2020, 2020.

Downloads

Published

Issue

Section

License

Copyright (c) 2022 Brazilian Journal of Radiation Sciences

This work is licensed under a Creative Commons Attribution 4.0 International License.

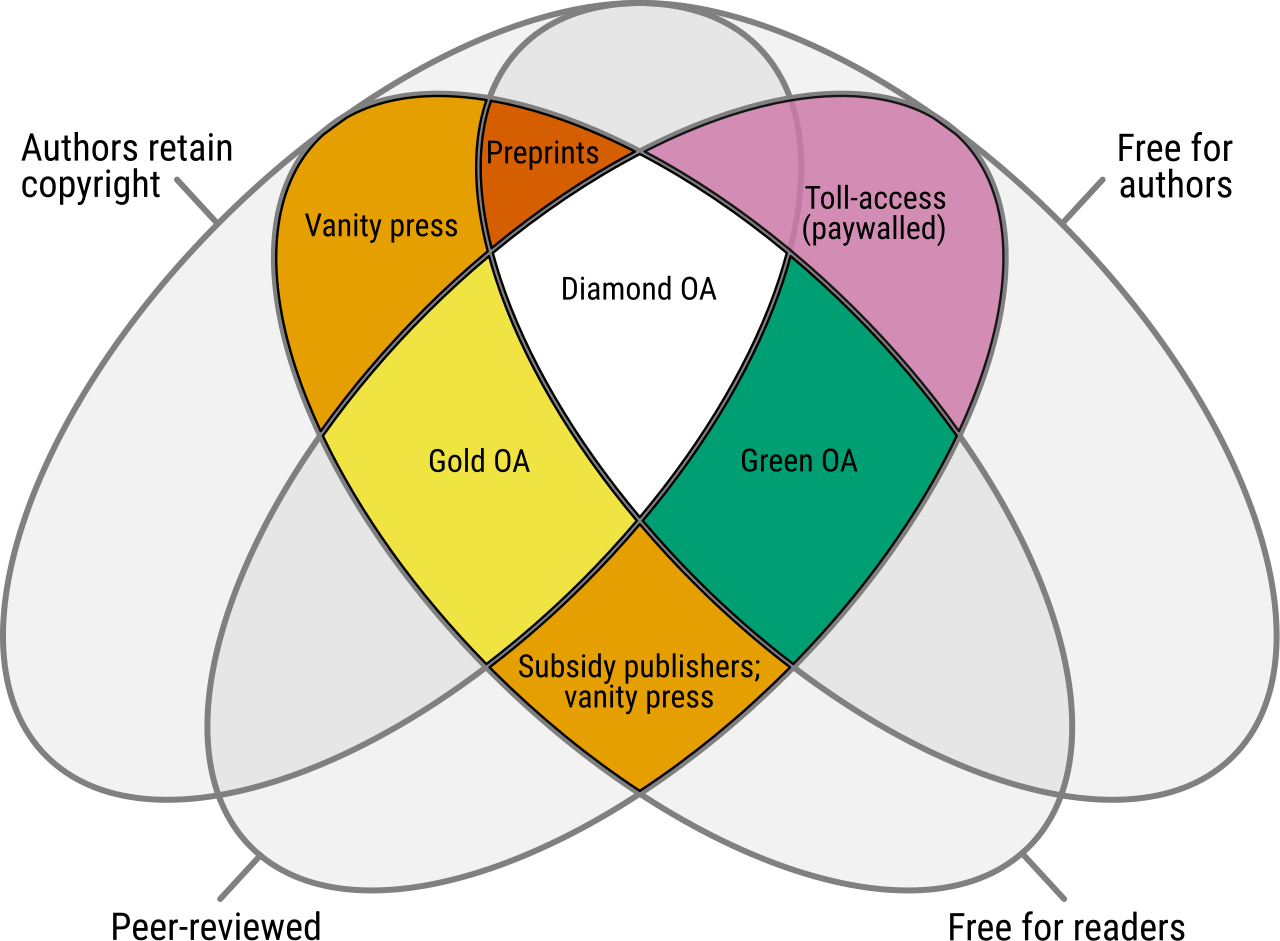

Licensing: The BJRS articles are licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons license, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this license, visit http://creativecommons.org/licenses/by/4.0/